When prospective customers type "banks near me" into a Google search bar, more often than not, they'll find a small number of negative reviews with little to no response from local branches. In fact, a customer is far more likely to see positive reviews of ... drumroll, please ... an auto dealership.

This, according to the " 2019 Retail Banking Report ," is because consumers on average find more reviews, responses and ratings for auto dealerships and property managers than for banks. The report was released by Reputation.com, a Silicon Valley software company that examines how the public perceives companies in more than 70 industries.

Several major U.S. auto lenders notably scored lowest among the banks that garnered negative traction from customers online. Search rankings, web traffic and revenue are on the line when businesses fail to maintain a positive web presence, Reputation.com also found. Appearing nonresponsive to customer concerns can cost a lender business across its entire portfolio, including auto lending.

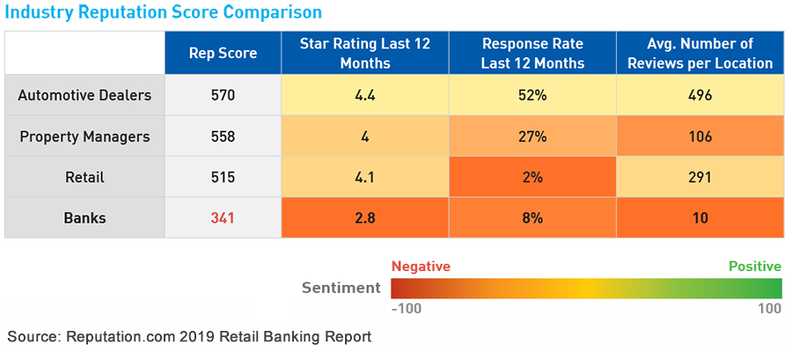

The banking industry overall pulled an average reputation score of 341 on a scale of 100 to 1,000 constructed using Google ratings, social media sentiment, customer reviews, online response rates to customer reviews and complaints and the site's own surveys. Capital One scored highest among the banks, with 405.

Auto dealerships scored 570 — but consumers are far more likely to review their local car dealership than their bank's branch. According to Reputation.com, the average number of reviews per location for auto dealers was nearly 500, compared with just 10 for banks.

Banks also responded far less frequently than auto dealers to consumer complaints. On average, banks responded 8 percent of the time — but many banks never do.

Of the 23 commercial bank brands included in the report, 10 of them — which includes major auto lenders SunTrust Banks and Santander Bank — failed to score above 300. All 10 had response rates of 0 percent for the past 12 months.

Auto dealers still have plenty of room for improvement. While their 52 percent response rate to customers was highest among the industries highlighted in the report, that leaves almost half of the online customer complaints tracked in the survey unanswered.

In auto finance, online presence matters when it comes to attracting and retaining customers. Lenders and auto dealers should make responding to customer comments online and investing in customer service and business development centers a priority.