Electrical Distribution Systems

Enabling safer, greener and more connected solutions

Signals transmission and power distribution at the right time to the right place

We have been designing electrical architectures for more than 100 years and leading the industry in the evolution of vehicle architectures.

We like to think of the electrical distribution system as a nervous system, moving power and data throughout a vehicle. High-speed data transmission systems send information from the vehicle’s eyes and ears (sensors) to the brain (computing platforms).

We bring our deep experience and systems integration expertise, whether we are building to print or providing full design services of the entire vehicle electrical architecture. We solve our customers’ most challenging problems.

Automotive Power Distribution Block Market by Type & Component - Global Forecast to 2025

[135 Pages Report] The automotive power distribution block market was valued at USD 6.29 billion in 2017 and is projected to reach USD 8.60 billion by 2025, growing at a CAGR of 4.15% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the Report

To define, segment, and forecast the automotive power distribution block market (2018–2025), in terms of volume (thousand units) and value (USD million)

To provide detailed analyses of the various forces acting in the market (drivers, restraints, opportunities, and challenges)

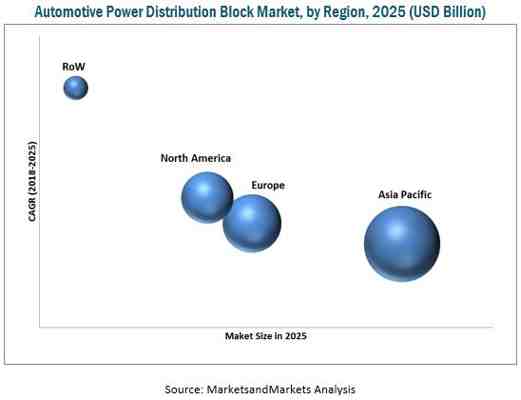

To segment the market and forecast the market size based on type, component, vehicle type, electric vehicle, off-highway vehicle, and region (Asia Pacific, Europe, North America, and the Rest of the World)

To segment the market and forecast the market size, by volume and value, based on type Hardwired and Configurable

To segment the market and forecast the market size, by value, based on component fuses, relays, CAN, and others

To segment the market and forecast the market size, by volume and value, based on vehicle type passenger cars, light commercial vehicles, and heavy commercial vehicles

To segment the market and forecast the market size, by volume and value, based on electric vehicle type BEVs, HEVs, and PHEVs

To segment the market and forecast the market size, by volume and value, based on off-highway vehicle agricultural tractors and construction equipment

To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of automotive power distribution block market. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate of automotive power distribution block by OEMs. The analysis has been discussed and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Society of Indian Automobile Manufacturers (SIAM), SAE International, and paid databases and directories such as Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive power distribution block market consists of automotive power distribution block manufacturers such as Eaton (Ireland), Lear (US), Sumitomo Electric (Japan), TE Connectivity (Switzerland), Yazaki (Japan), and Littelfuse (US).

Target Audience

Automotive Power Distribution Block Manufacturers

Automotive Fuse Manufacturers

Automotive Relay Manufacturers

Automotive Safety and Comfort System Manufacturers

Industry Associations

Raw Material Suppliers for Automotive Power Distribution Block

The Automobile Industry as an End User

Traders, Distributors, and Suppliers of Automotive Power Distribution Block

Get online access to the report on the World's First Market Intelligence Cloud Easy to Download Historical Data & Forecast Numbers

Easy to Download Historical Data & Forecast Numbers Company Analysis Dashboard for high growth potential opportunities

Company Analysis Dashboard for high growth potential opportunities Research Analyst Access for customization & queries

Research Analyst Access for customization & queries Competitor Analysis with Interactive dashboard

Competitor Analysis with Interactive dashboard Latest News, Updates & Trend analysis Request Sample Click on image to enlarge Scope of the Report

Automotive Power Distribution Block Market, By Type

Hardwired

Configurable

Automotive Power Distribution Block Market, By Vehicle Type

Passenger Car

LCVs

HCVs

Automotive Power Distribution Block Market, By Electric Vehicle Type

BEV

HEV

PHEV

Automotive Power Distribution Block Market, By Off- Highway Vehicle Type

Agricultural Tractors

Construction Equipment

Automotive Power Distribution Block Market, By Component

Fuse

Relay

CAN

Others

Automotive Power Distribution Block Market, By Region

Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of Asia Pacific)

Europe (Germany, France, Russia, Spain, Turkey, the UK, and Rest of Europe)

North America (US, Mexico, and Canada)

Rest of the World (Brazil, Iran, and Others)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

The following customization options are available for the report:

Additional Company Profiles

Business Overview

SWOT analysis

Recent developments

MnM view

Detaled Analysis of Automotive Power Distribution Block Market By Vehicle Type

Drivers

Increasing adoption of electronic functions in a vehicle

The adoption of electronic content in vehicles has increased rapidly in the last two decades. The pace is poised to accelerate further. Further, the adoption of advanced electronics in smart vehicles would enable vehicle users to use features such as in-car payment services, on-road entertainment, connected services, etc. The increasing consumer preference for these features is a major driving force for the growth of the electronic cockpit systems. Moreover, stringent safety norms imposed by governments and legislative agencies have forced automobile manufacturers to make vehicles safer by providing features such as anti-lock braking systems (ABS), electronic brake-force distribution (EBD), telematics, adaptive lighting, and airbags. These safety features rely heavily on inputs from electronic control units.

Restraints

Lack of technological innovations in the power distribution box

A hardwired power distribution box uses traditional power transmission components such as fuses, relays, connectors, wires, etc. This type of power distribution box is widely used in the vehicle power distribution market, particularly in the Asia Pacific region. The passenger car market in developing economies such as China, Brazil, and India has a large market share of this type of power distribution box. Also, the hardwired power distribution box is widely used in heavy commercial and off-highway vehicles because of its cost-effectiveness, reliability, and load carrying capacity. However, the use of this type of power distribution box increases the number as well as the size of cables, which in turn increases the overall weight of the vehicle. The increase in vehicle weight is a major problem for the manufacturers of vehicle power distribution box.

Opportunities

Rapid technological changes in the commercial vehicle segment

The market for commercial vehicles is growing at a significant rate. The rapid development of infrastructure, especially in countries such as China and India, is supporting the growth of the commercial vehicle market. According to the Department of Statistics, Stanford University, spending on infrastructure development in China increased by almost 50% from 2015 to 2016. Increasing investments in infrastructure have propelled the demand for HCVs. Also, the growing demand for freight transportation is driving the market for HCVs.

New Product Developments

Company Date Description Leoni July 2017 Leoni presented the next generation of its modular system for high-voltage power distribution in electric and hybrid vehicles at the IAA International Motor Show in Frankfurt. The further-developed Y-splitter is more variable, lighter, and less expensive than comparable products. Littelfuse April 2016 Littelfuse added two new power distribution products to its commercial vehicle products offering. The new products, HWB6 and HWB12, complement the existing product family with the addition of two more compact options to their wide variety of rugged vehicle electrical modules. The HWB family is ideal for accessory circuits, overflow circuits, and can even be used as a main unit on smaller vehicles.

Source: Press Releases, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

Expansions

Company Date Description Eaton May 2018 Eaton announced its long-term commitment to be present and serve the Israel market through the establishment of Eaton Israel. The company will operate through two sites—a sales, marketing, and support center in Ra'anana and a logistics and distribution center in Ashdod. The products and services offered in Israel include power distribution, energy storage, industrial automation, and data center solutions, as well as life safety products for fire detection, emergency notification, and safe evacuation including adaptive emergency lighting systems. The company aims to double its sales in Israel over the next three years. Yazaki September 2018 Yazaki expanded its operations in Texas to include manufacturing of dealer parts and service components and established a manufacturing development center for engineering.

The facility, located in El Paso, produces parts for services such as fuse boxes, electronic modules, and remote keyless entry systems. Column switches, electric vehicle charge couplers, and instrument panel clusters will also be produced at the facility.

Source: Company Website, Annual Reports, and MarketsandMarkets Analysis

The automotive power distribution block market is projected to grow at a CAGR of 4.15% from 2018 to 2025. The market is estimated to be USD 6.47 billion in 2018 and is projected to reach USD 8.60 billion by 2025. The market growth can be attributed to the increasing adoption of vehicle electronic functions that require a reliable, flexible, robust, and efficient power distribution system.

The configurable power distribution box is estimated to be the fastest growing segment of automotive power distribution block market. The configurable power distribution box combines fuses, relays, microcontrollers, and multiple (circuit board and fret) layers of interconnections into a single integrated assembly to distribute power for different applications. Also, this type of a power distribution box is more suitable for a complex electronic control system.

By vehicle type, the passenger car segment is estimated to hold the largest share of the automotive power distribution block market. The rise in the production of passenger cars globally, increasing demand for premium vehicles and SUVs, and increasing preference for high-performance personal vehicles are fueling the growth of the passenger car market. Also, the global demand for passenger cars is higher than that for commercial vehicles and is expected to grow further in the future. Additionally, factors such as the sizeable number of luxury light-duty vehicles in Europe and North America and the increasing demand for these vehicles in the Asia Pacific region are increasing the demand for automotive power distribution block in this vehicle segment.

The automotive power distribution block market for Battery Electric Vehicles (BEVs) segment is estimated to be the fastest growing market. Factors such as strict emission norms by the government, the rise in ecological imbalance due to excessive carbon emission, and less energy consumption are promoting the growth of BEVs.

By off-highway vehicle type, the construction equipment is estimated to be the fastest growing segment of automotive power distribution block market. Rapid development of infrastructure, especially in countries such as China and India, is supporting the growth of this market.

The Asia Pacific region is estimated to dominate the automotive power distribution block market for automotive, by volume as well as value. The growth of this market can be attributed to the increase in production and demand for passenger cars and electric vehicles. Also, the increasing adoption of advanced cockpit electronic functions in vehicles, growing purchasing power of the population, and increasing consumer awareness for safety features in developing countries are the key factors driving the market in the Asia Pacific region.

A key factor restraining the growth of the automotive power distribution block market is the lack of technological innovation in power distribution box. A hardwired power distribution box is cost-effective but requires more space and adds to the overall weight of the vehicle. On the other hand, a configurable power distribution box reduces the number of fuses and other components and thus helps in reducing the overall weight of the vehicle. However, the cost of this type of a power distribution box is higher than a hardwired power distribution box. Manufacturers should offer a solution that can meet both requirements weight reduction and cost-effective system.

Some of the key market players are Eaton (Ireland), Lear (US), Sumitomo Electric (Japan), TE Connectivity (Switzerland), Yazaki (Japan), and Littelfuse (US).

Challenges

Increasing complexity in the design of the vehicle power distribution box

In today’s market, components are much cheaper, technology has improved considerably, and several mechanically-operated systems and components are being converted to electrical to reduce the weight of the vehicle. For instance, the use of an electric power steering over hydraulic power steering leads to a saving of 2 to 4% in the fuel consumption of a vehicle. Also, OEMs have started offering premium features in their mid-segment vehicles to differentiate themselves from the competitors. Some of these features are ambiance lighting, powered sunroof, powered tailgate, digital instrument clusters, and infotainment systems. With increasing demand, these features would become a standard offering for the mid-segment vehicles. Moreover, the advent of semi-autonomous and autonomous vehicles has fueled the use of ADAS features in all variants of vehicles. The use of ADAS features leads to an increase in vehicle electrification, which in turn requires more power supply. The increased need for power compels manufacturers to increase the number of components and size of the power distribution box, which in turn increases the complexity in the design of the power distribution box. The increased complexity in the design of the power distribution box is the major challenge for vehicle power distribution manufacturers.

Partnerships/Supply Contracts/Collaborations/Joint Ventures

Company Date Description Sumitomo Electric February 2018 Sumitomo and NEC Corporation collaborated for the development and planning of automotive components in the mobility business segment. With this development, the companies plan to develop and demonstrate software and hardware for transportation and in-vehicle infrastructure. The companies will exploit the provisions of artificial intelligence and internet of things (IoT) technologies in cascading effect. Sumitomo Electric November 2017 Sumitomo and GoMentum Station entered into a partnership to develop autonomous and connected vehicle technologies. This move would help introduce advanced automated vehicle technology by utilizing the resources of GoMentum Station.

Source: Press Releases, Annual Reports, and MarketsandMarkets Analysis

Acquisitions/Agreements

Company Date Description Littelfuse March 2016 Littelfuse successfully acquired the circuit protection business of TE Connectivity for USD 350 million. After the acquisition, Littelfuse strengthened its core circuit protection business by adding new products and new markets from TE connectivity. Littelfuse July 2017 Littelfuse acquired the assets of JRS MFG. LTD., headquartered in Winnipeg, Manitoba, Canada. JRS MFG. LTD. provides custom engineered and manufactured products for the electrical industry with a primary focus on the mining and utility markets.

Source: Press Releases, Annual Reports, and MarketsandMarkets Analysis

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Power Distribution Units Automotive

Power Distribution Units

MTA Power Distribution Units are studied and realized to meet OE customers needs. MTA Power Distribution Units allow power distribution and the protection of primary and non primary services. They also allow a better rationalization of loads and consequently a better layout in the engine compartment.

PDU are available in two different solutions: “hard-wired” and “stand-alone” . For the first a bus-bar solution is chosen, while for the second type MTA uses PCB technology.

Hard-wired/bussed PDUs

Power Distribution Units manufactured using wired technology and with bus bar can be supplied complete with fuses or in the multi-fuse versions.

Appropriate supports, connectors and terminals complete the range, so as to provide customers with a single interface for the whole system.

PCB PDUs

PDUs designed and developed with PCB technology offer the utmost in customization, connectivity and serviceability. They are studied in different dimensions and geometries according to customer’s needs. PCBs can be equipped with fuses, relays, modular or single fuse holders and connector pins. The components are assembled on the PCB using press-fit and/or reflow soldering. Hybrid solutions (PCB and hard-wired) are also possible.

Need additional information?