AutoNation Inc. is boosting its plans for used-only AutoNation USA stores and now aims to operate more than 100 of the outlets by 2030, including in new markets. The company said it expects 55 to be open by the end of 2025.

The auto retail giant made the announcement as it reported higher third-quarter net income Wednesday , a result aided by jumps in new- and used-vehicle gross profits and lower expenses.

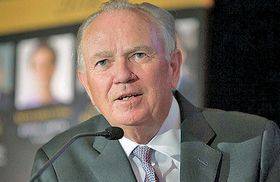

"It's our absolute best quarter ever," AutoNation CEO Mike Jackson told CNBC on Wednesday.

Net income soared 84 percent to $182.6 million. Revenue slipped 1 percent to $5.4 billion.

The nation's largest new-vehicle retailer said its adjusted net income from continuing operations essentially doubled, rising 99 percent to $211.8 million. The company said it recorded $28 million in after-tax charges associated with the closing of its collision parts business and a $2 million noncash after-tax loss related to its investment in online used-vehicle retailer Vroom.

In July, AutoNation said it planned to spend up to $220 million to build 20 or more AutoNation USA stores over the next three years . The company announced this week that it plans to open five such stores by the end of next year.

The retailer also said Wednesday that it has established a long-term goal to sell more than 1 million new and used vehicles per year, about double its combined sales last year of 528,715 vehicles.

AutoNation shares closed Wednesday's trading up 1.9 percent to $64.24.

Record: All-time adjusted earnings per share from continuing operations of $2.38.

Sales: New-vehicle sales dropped 11 percent to 65,998. Used-vehicle sales rose 1.6 percent to 64,587.

Same-store sales: New-vehicle sales on a same-store basis fell 9.9 percent to 65,998. That compares with a U.S. new light-vehicle sales decline of 9.5 percent during the third quarter, according to the Automotive News Data Center. Used-vehicle sales on a same-store basis increased 3 percent to 64,587.

Inventory issues

Jackson also warned new-vehicle inventories remain thin as automakers miss resupply deadlines, which may mean fewer choices and higher prices for buyers. He told analysts that he expects shortages will last at least through the end of the year.

“We’ve had, of course, running conversations with the manufacturers since this spring, and every target has been missed,” Jackson said on the call. “What we’ve been told we would be shipped, it simply did not happen.”

U.S. carmakers have struggled to ramp up production after a two-month long shutdown this spring to contain COVID-19. While consumer demand has rebounded thanks to low interest rates and a shift towards private transportation, automakers have been stretched thin by absenteeism, distancing protocols, quarantines and supply-chain constraints.

General Motors faces tight inventories for trucks such as its Chevrolet Silverado and GMC Sierra and is running pickup plants on all three shifts, it said earlier this month. Low supply also hampered BMW AG’s third-quarter sales, causing it to fall to third place among U.S. luxury brands.

AutoNation, of Fort Lauderdale, Fla., ranks No. 1 on Automotive News ' list of the top 150 dealership groups based in the U.S., with retail sales of 282,602 new vehicles in 2019.

Bloomberg contributed to this report.